Crude oil prices hit a seven-year low

January WTI (West Texas Intermediate) crude oil futures contracts trading on NYMEX fell by 3.1% to $35.62 per barrel on Friday, December 11, 2015. Global benchmark Brent oil prices fell by 4.5% to $37.93 per barrel on the same day. Prices hit record lows due to the consensus of excessive supplies and mounting short positions. The United States Oil Fund LP (USO) and the ProShares Ultra DJ-UBS Crude Oil ETF (UCO) fell in the direction of crude oil prices in Friday’s trade.

IEA report

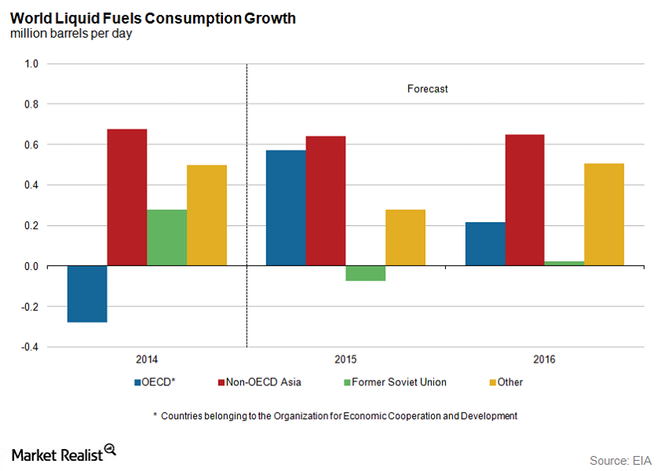

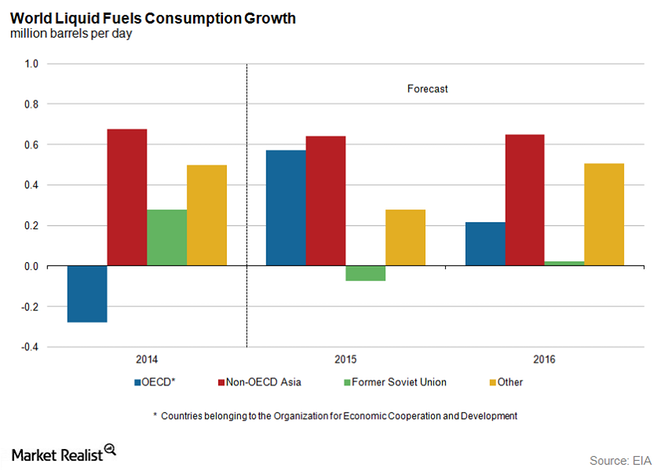

The International Energy Agency (IEA) released its monthly Oil Market Report on December 11, 2015. The report projects that global demand growth will slow down in 2016. The IEA estimates that global consumption will increase to 1.2 MMbpd (million barrels per day) in 2016.

The Paris-based agency also reported that OPEC’s (Organization of the Petroleum Exporting Countries) production hit a seven-year high of 31.7 MMbpd in November 2015. Weak demand and excess supplies ignited fear of oversupply, and panic selling started. As a result, US oil prices fell to a new low of $35.16 per barrel on Friday, December 11. US crude oil prices tested December 2008 lows.

Meanwhile, oil prices have fallen almost 16% in December 2015. Why? The OPEC meeting held on December 4 suggested that countries like Saudi Arabia, Iran, and Iraq would scale up production in 2016 despite rock bottom oil prices. OPEC also removed its 30 MMbpd group quota. Libya might resume its production, and Russia will continue to produce at record levels. The United States, the Middle East, and China have record crude oil and refined products inventories despite ongoing maintenance and the winter season.

The strengthening US dollar (UUP) has also weighed on crude oil prices. All these factors have caused crude oil prices to fall 16% in December 2015. The bloodbath in the crude oil market also led to the fall of the SPDR S&P 500 (SPY) on Friday, December 11. The energy sector has been among the worst performers so far in 2015. Record-low oil prices also affect oil producers like Apache Corporation (APA), Hess Corporation (HES), and Occidental Petroleum Corporation (OXY). These stocks fell more than 3% on Friday.

Warm weather and hedge funds

Warmer-than-normal winter weather due to the El Niño weather pattern is curbing the heating demand and consequently crude oil demand. All fundamental parameters are against crude oil prices. As a result, hedge funds also increased their bearish bets by 5.8% for the week ending December 8, 2015, as compared with the previous week, per the CFTC (Commodity Futures Trading Commission). In contrast, long positions have hit a five-year low.

Source: www.marketrealist.com