In September, energy prices rose 0.9%, while non-energy commodities slipped 0.8%.

Food prices dropped by 1.0%. Beverages increased 0.9%.

Raw materials fell 0.1%, and fertilizers rose 0.7%.

Metals and minerals fell 1.6%, and precious metals by 1.2%.

Most commodity prices continued to rise in the third quarter from their lows in early 2016. Crude oil prices are forecast to rise to $55 per barrel in 2017 from an average of $43/bbl this year as the market continues to rebalance and OPEC is likely to limit output. Metals prices are projected to rise more sharply in 2017 than forecast in July, as a result of faster-than-expected mine closures. Agricultural commodities prices are anticipated to rise slightly in 2017 after a minimal decline this year but with wide variations in the outlook for different commodities depending on supply conditions. This issue of the Commodity Markets Outlook analyzes OPEC’s recent decision to limit output by examining earlier commodity agreements and assessing the implications of changing market forces over the past decades. It concludes that commodity agreements have limited ability to influence global prices over extended periods of time and eventually collapse, often with unintended consequences. The ability of OPEC, the only surviving commodity organization seeking to influence markets, will be tested in the presence of unconventional oil suppliers, notably the U.S. shale oil industry.

Trends.

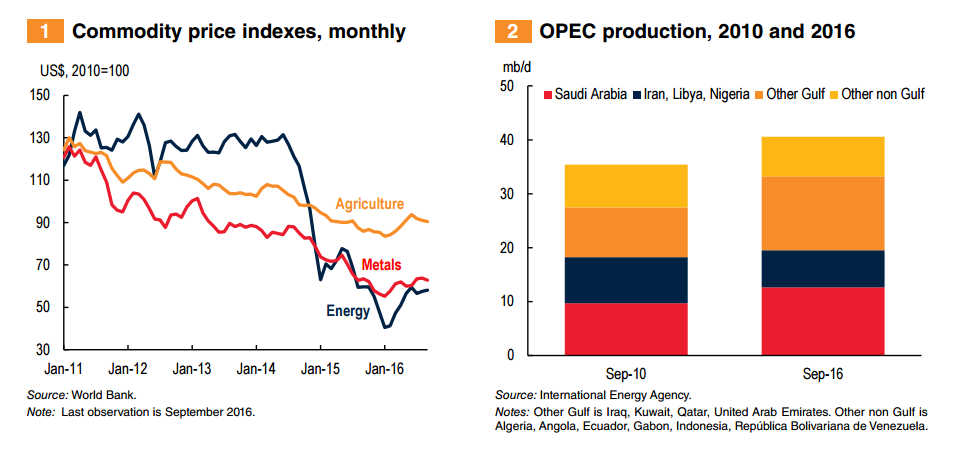

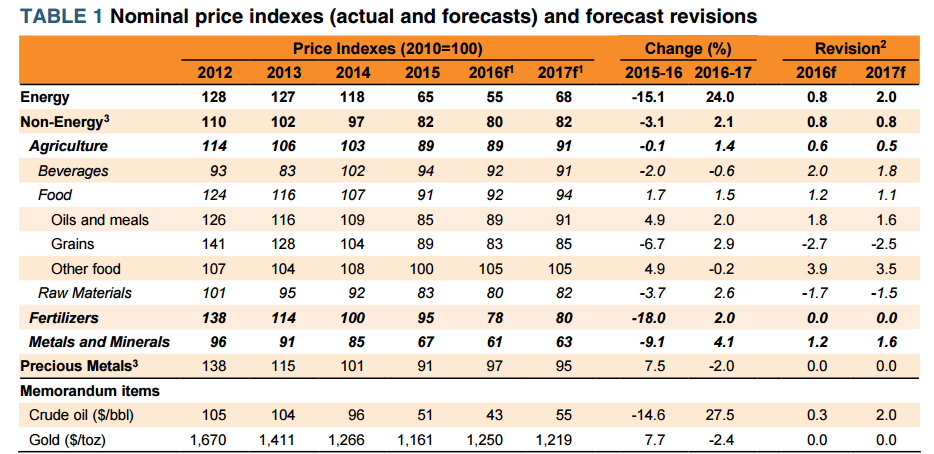

Energy prices rose more than 3 percent in the third quarter of 2016 from the second quarter (Figure 1). Coal prices surged 30 percent, reflecting strong import demand and tightening supply in China following restrictions on production aimed at reducing pollution. U.S. natural gas prices jumped more than 33 percent due to strong demand for air conditioning, falling production, lower injections into storage, and increased exports to Mexico and to South America during the southern hemisphere winter. Crude oil prices were slightly lower in the quarter, averaging $44.7/bbl, as supply returned to the market, notably in Canada, after wildfires in the spring. OPEC production edged up, with most of the gains coming from Iran and Saudi Arabia. Oil prices jumped in late September, when OPEC members announced a plan to limit oil output. The details of this agreement are expected to be finalized at the group’s meeting in November. The Islamic Republic of Iran, Libya and, Nigeria are likely to be excluded from the agreement (Figure 2).

The Non-Energy Commodity Price Index rose marginally in the third quarter with large variations across individual commodities, mostly because of supply conditions. Metals prices increased 4 percent from the second quarter due to mine closures in a number of countries and production cuts. Precious metals prices jumped 8 percent in the third quarter due to strong investment demand following the U.S. Federal Reserve’s delay of an expected interest rate increase, although the trend has reversed on heightened expectations of a rate rise in December. The Beverage Price Index rose 4 percent, led by a 10 percent increase in coffee prices as a result of drought-related crop losses. Grains prices declined 8 percent following wheat and maize price drops of 15 percent and 10 percent, respectively, attributable to record crops.

Outlook and risks.

All main commodity price indexes are projected to decline in 2016 from the previous year, with the exception of food and precious metals, reflecting well-supplied markets (Table 1). The declines for most indexes are smaller than expected in the July, with some exceptions. Prices for most commodities are expected to rise in 2017. Energy prices are forecast to increase 24 percent in 2017 after dropping 15 percent this year. Oil prices are expected to average $55/bbl, next year, higher than the $53/bbl forecast in July, reflecting OPEC’s intention to limit output. Upside risks to the oil price forecast include further supply disruptions among key producers and stronger-than-expected OPEC production cuts. In contrast, greater-than-expected oil output and further weakening in EMDE economic growth could lower prices.

Non-energy commodity prices are expected to rise 2 percent in 2017 after a 3 percent drop the previous year. Metals prices are forecast to rise 4 percent in 2017 after a 9 percent slide in 2016. Zinc, lead, and tin prices are projected to increase due to tightening supplies. Downside price risks for metals include a further slowdown of growth in China and higherthan-expected production, while upside risks relate to government-directed supply restraint in Asia and reluctance by producers to activate idle capacity as demand picks up. Precious metals prices are projected to decline in 2017 as benchmark interest rates rise and safe-haven buying ebbs. Although, on average, the Agricultural Price Index is expected to remain broadly stable in 2017, the outlooks for its components vary depending on supply conditions. A small increase of 1.5 percent in the Food Price Index largely reflects an anticipated 2.9 percent rebound in grains prices. This is expected to be a correction from the price decline in 2016 that resulted from larger-than-expected crops of maize in the United States and wheat in Australia and Central Asia. Upside risks to the agricultural price forecasts include worsening weather conditions in South America and East Asia and a larger-than-expected increase in energy prices, a key cost component. Risks of disruptions from the La Niña weather pattern are limited. Downside price risks include the possibility of increased agricultural subsidies, which would encourage greater supplies as well as diminished diversion of food commodities to the production of biofuels.

Special Focus on OPEC production in the context of commodity agreements and market fundamentals. On September 28, OPEC agreed to limit crude oil output to 32.5-33.0 million barrels per day, effectively ending two years of unrestrained production. This marked an important policy shift, especially for Saudi Arabia, the organization’s largest producer. The details of the new plan are to be worked out and announced at the group’s meeting on November 30. The Islamic Republic of Iran, Libya, and Nigeria, all OPEC members, are likely to be exempted from the production limits because of earlier production losses. The plan, if implemented, would be the first production cut since 2008. OPEC is also preparing a framework for consultations with non-OPEC producers including the Russian Federation. The Focus section concludes that commodity agreements have limited ability to influence the market and eventually collapse, often with unintended consequences. In the case of OPEC, the only surviving commodity organization seeking to influence markets, guiding global oil prices will be challenging in the presence of unconventional oil producers, notably the U.S. shale oil industry.

Source: World Bank Group