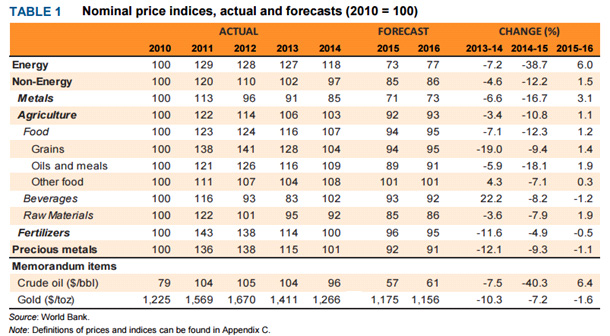

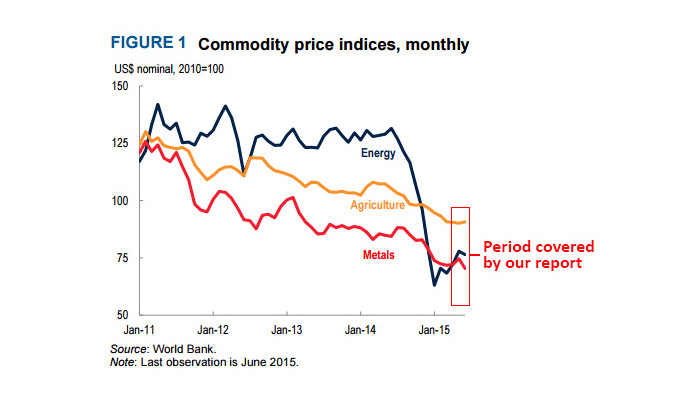

According to The World Bank’s Commodity Market Outlook for the third quarter of 2015 most prices declined in the second quarter of 2015 due to ample supplies and weak demand, especially in industrial commodities (see figure below).

Energy prices rose 12 percent in the quarter, with the surge in oil offset by declines in natural gas (down 13 percent) and coal prices (down 4 percent). However, energy prices fell on average to 39 percent below 2014 levels. Natural gas prices are projected to decline across all three main markets—U.S., Europe, and Asia—and coal prices to fall 17 percent. Excluding energy, our report notes a 2 percent decline in prices for the quarter, and forecasts that non-energy prices will average 12 percent below 2014 levels this year. Iran’s new nuclear agreement with the US and other leading governments, if ratified, will ease sanctions, including restrictions on oil exports from the Islamic Republic of Iran. Downside risks to the forecast include higher-than-expected non-OPEC production (supported by falling production costs) and continuing gains in OPEC output. Possible (less likely) upside pressures may come from closure of high-cost operations—the number of operational oil rigs in the US is down 60 percent since its November high, for example—and geopolitical tensions.

Metals prices declined marginally in the quarter as most are still in surplus - particularly iron ore where prices are off two-thirds from their 2011 high. We project metals prices to average 16 percent below 2014 levels this year, revised downward from 12 percent in April. The largest decline is expected for iron ore (down 43 percent) due to new low-cost mining capacity coming online this year and next (mainly in Australia). Metals markets are adjusting by closures of high-cost operations and reduced investment. Markets will eventually tighten, in part due to large zinc mines closures, and as Indonesia’s ore export ban weighs on supplies, notably nickel.

Agricultural prices fell 2.6 percent in the quarter, due to large declines in food commodities – especially edible oils and grains – on further improvements of supply conditions and despite some adverse weather in North America and El Niño fears. We expect agriculture prices to average 11 percent below 2014 levels this year, revised downward from 9 percent in April. Fertilizer prices, a key cost for most agricultural commodities, are likely to decline 5 percent on weaker demand and ample supply.